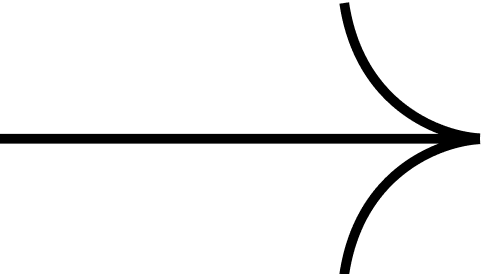

We sit at the intersection of your business systems / your financial records / your business and personal tax .

This is the routine list of “HOW” we do what we do to help you

Systems / Outsource “back office” support

We set up all business clients on the best cloud system: Xero

Typically you only need to:

deal with your customer-facing processes - raising sales invoices

you take pictures of receipts and forward cost invoices

—> that would be all you need to do to have the bookkeeping done

We deal with codings / reconciliations etc etc

We will also set you up on other systems that link to and from Xero automatically

Advice

Dealing with all the details & transactions is one thing you can also expect:

a sounding-board to talk through business issues that are worrying you

advice on keeping things tax-efficient (but we do not do risky tax “strategies” that HMRC can challenge so you can sleep at night if you work with us)

reports on how the trading &finances are looking - live online charts if they help you

business planning / business models

Tax filings

We generate and check:

VAT Returns

Income Tax Returns

Corporation Tax Returns

Employer filings (of course we do payroll too)

Companies House Accounts

—> these are all shared online to you - so that you have sight of things before they go into